9 KEY POINTS OF FDI IN INDIA

CS GOURAV SARAF

CS GOURAV SARAF is an Associate Member of the Institute of Company Secretaries of India. Having a work experience of 7+ years. Practicing as a Company Secretary in corporate law. He is based out of Kolkata, India

POINT – 1: PAST HISTORY

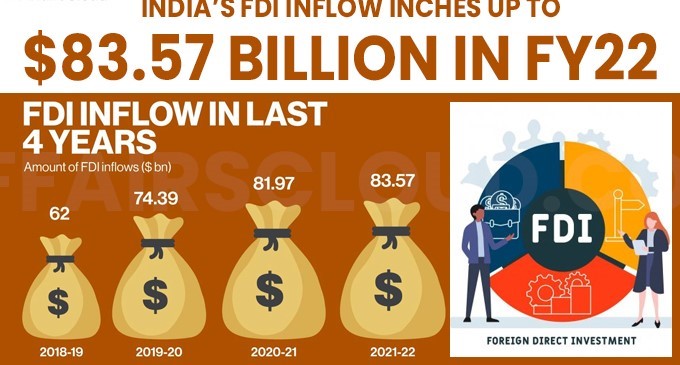

Total FDI inflow in the Country in the last 24 years (Apr 2000 to March 2024) are $990.97 Bn while the total FDI inflows received in the last 10 years (Apr 2014 to March 2024) was $667.410Bn which amounts to nearly 67% of the total inflow in last 24 years

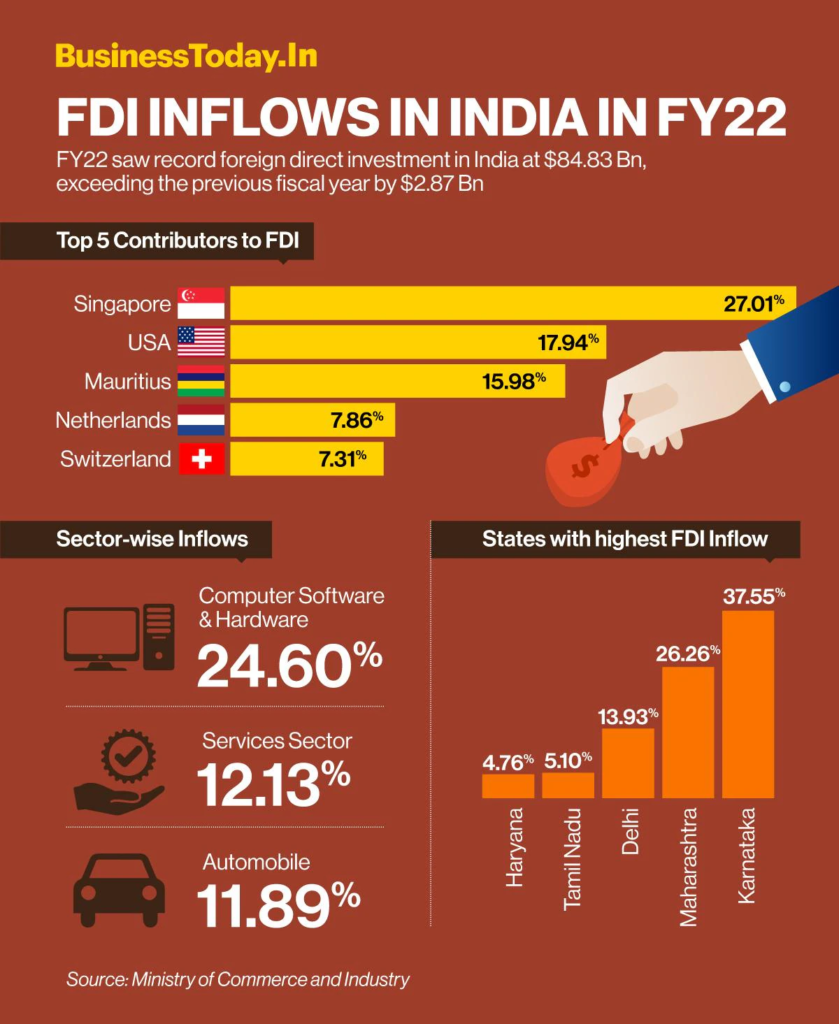

POINT – 2: MAIN COUNTRIES, STATES, SECTORS OF FDI

Main Countries attracting FDI in India are Singapore, Mauritius, USA, Netherland, Japan, UK, Switzerland as of 2024. Sectors attracting FDI are Finance, Banking, Insurance, Computer Software Hardware, Automobile.

States having large FDI are Delhi, Tamil Nadu, Gujarat, Maharashtra, Karnataka

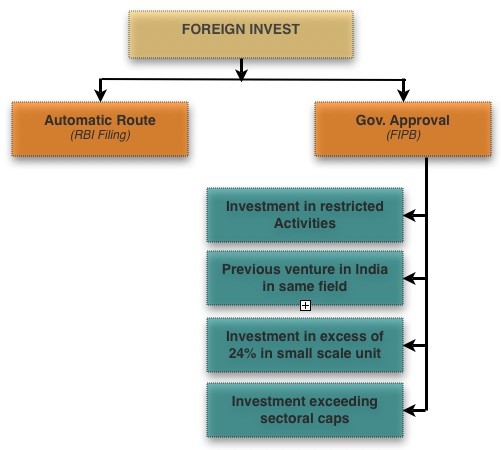

Point -3: Automatic Route

Union Minister Dr. Jitendra Singh announced that India has attracted over US$ 120 million (Rs. 1,000 crore) in investments in space startups within the first nine months of FY24, owing to the opening up of the space sector for private players by Prime Minister Mr. Narendra Modi. The sector has also witnessed a surge from one startup to nearly 190 in four years.

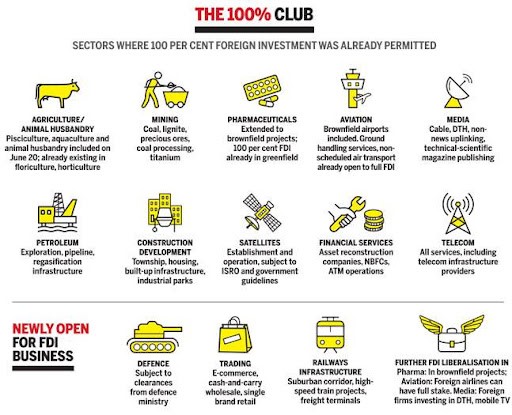

Point – 4: Government Route

As of February 9, 2024, companies in the defence sector have disclosed FDI valued at US$ 612 million (Rs. 5,077 crore). The government further encourages FDI by fostering collaboration on specialized defence technologies with foreign OEMs.

Point – 5: Filing of Application

- Filing of application in www.fifp.gov.in/ 2)DPIIT will identify concerned ministry/department and circulate the proposal within 2 days to Ministry, FEMA and RBI. 3) DPIIT will comment within 4 weeks of the application and Ministry/department within 6 weeks. Additional Information within 1 week. 4) Final Approval within 8 – 10 weeks.

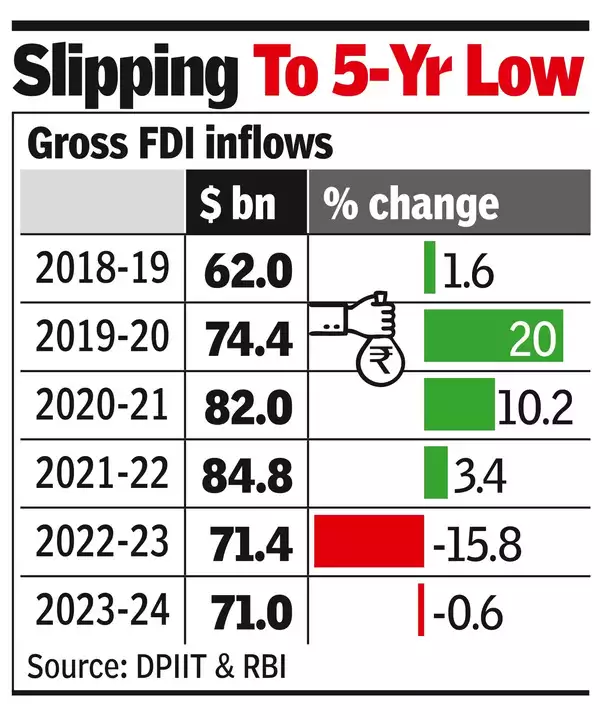

Point – 6: Decline in FDI

The decline in global Foreign Direct Investment has impacted FDI flows to India.

Net FDI inflows to India declined from USD 42.0 billion during FY23 to USD 26.5 billion in FY24. The contraction in net inflows was mainly due to repatriation/disinvestment due to many profitable exits. The main factor for decline in FDI is Political instability, Infrastructure, Tax, Government Regulations & Labour Laws.

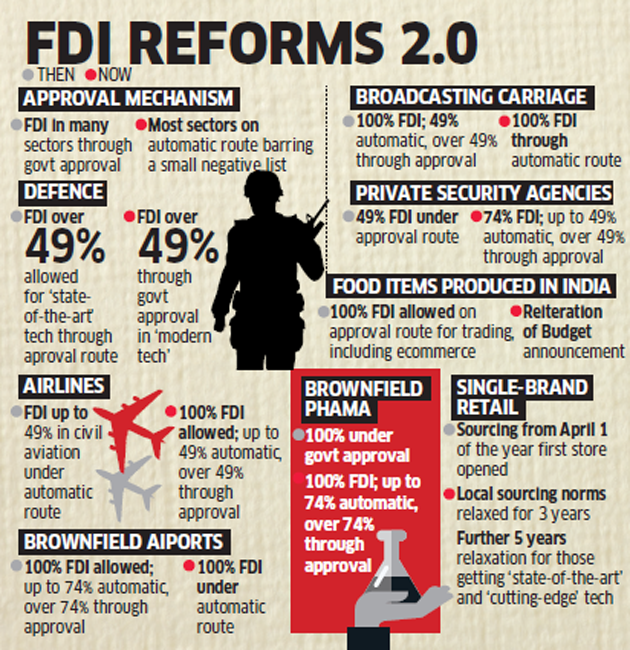

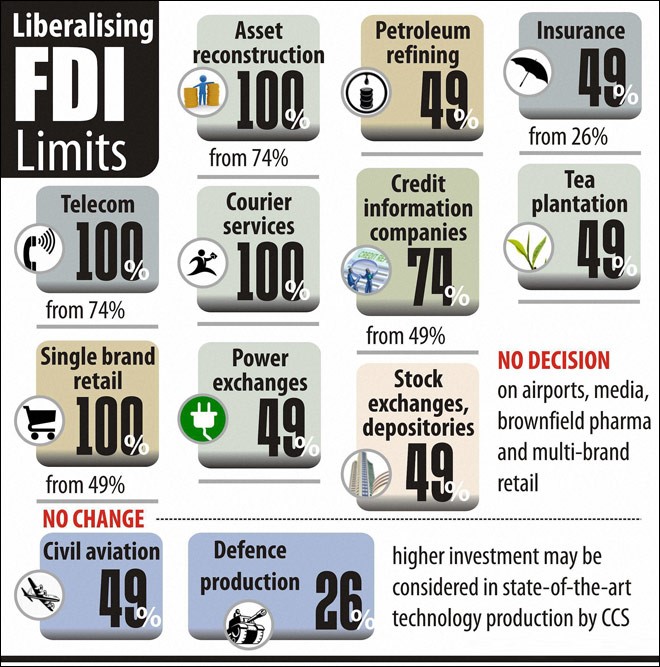

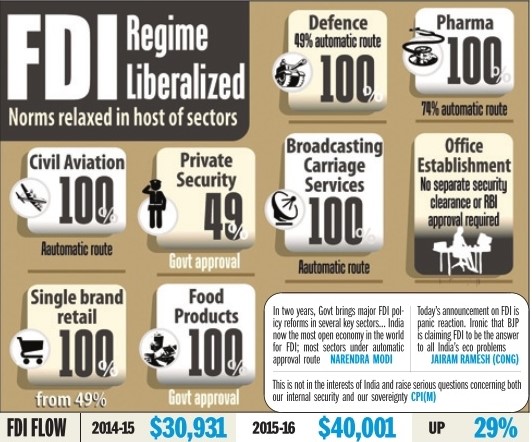

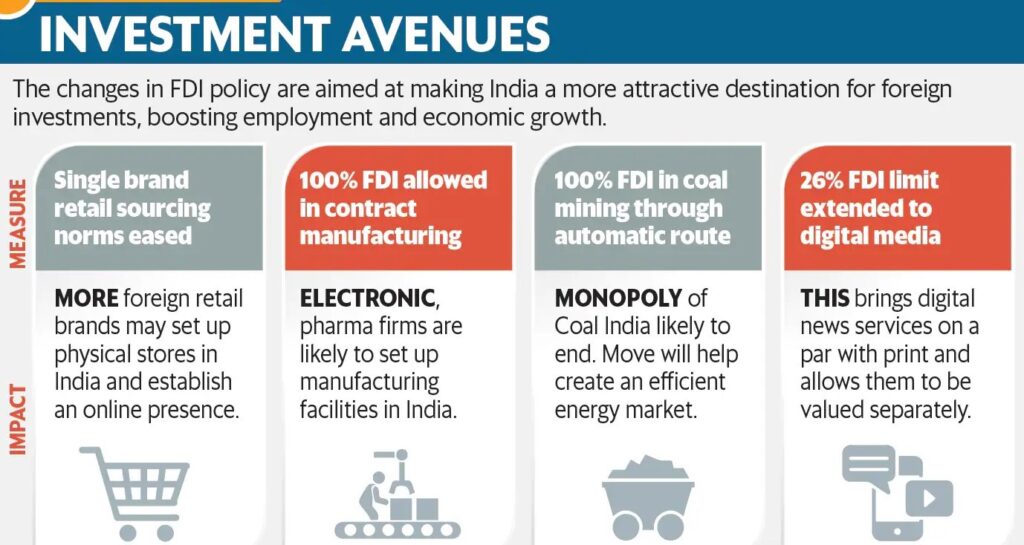

Point – 7: Government Initiative

In Budget 2024 there were relaxation of angel investment, equalization levy tax, Rate of Tax for Foreign Company was slashed by 5%. Aims to relaxation in FDI norms.

Point – 8: Sectors to Look into Future

Government is taking initiatives to Make in India, MSME sector uplifting through production link subsidy there by aligning itself to China +1 strategy. Subsidies for electronics, Solar Power, Pharma Industries

Point – 9: FDI Going Forward