Valuation of Intangible Assets

Neeraj Agarwal

I Neeraj Agarwal, am a Fellow Member of ICAI, practicing under the banner of M/s AAN & Associates LLP, a firm based out of Banglore Mumbai.

I am also registered under Insolvency and Bankruptcy Board of India as a Registered Valuer for valuation of Security or Financial Assets (Passed in Feb 2020)

I am also holding Bachelor of Commerce (B. Com) degree from Calcutta University (Passed in 2011).

I have corporate working experience in Wipro. After working in Wipro for a short period I started my practice in late 2013 and have been in practice so far for the last 10 years. I have also completed a Certificate Course by ICAI on IND-AS in 2020. I have also cleared Social Auditor Exam conducted by NISM.

I have been inducted as a Special Invitee to the Sustainability Reporting Standard Board, ICAI for the FY 2023-24.

Introduction

Intangible assets in a company’s balance sheet have monetary or business value hidden but are not present in the physical form. Simply put any asset that provides future benefits to the entity and on which some economic value can be affixed but that can’t be seen in physical form, can be described as Intangible Asset (IA). Intangible assets generally help companies by uniquely performing operations giving them a competitive edge.

For example, intellectual property like patents, trademarks, and copyrights are intangible assets. All businesses gain access to intangibles by creating them or acquiring intangibles from other businesses.

The brand value of a firm can also conceal the intangible value of a business. Different businesses exhibit Unique Selling Points that can be considered part of the intangible value of businesses.

Why Intangible Valuation is Crucial?

In recent years technology-based companies have taken the lead in valuations. These companies don’t have tangible assets like plant & machinery or real estate. So why do these companies have such high valuations when going for capital funding?

This is because of the IA that are increasing their valuations. Just imagine, the value of companies like Zomato, Paytm, etc if we only value them for their physical assets. Hence IA valuation cannot be taken lightly.

There can be different reasons to value intangibles, some of them are listed below –

- Determining the Asset Value:

An intangible asset is a non-physical asset. The value at which it has to be disclosed should be determined accurately to give a true and correct picture of the Financial Asset. If an intangible asset is organically grown, it becomes difficult but important to derive its value. - Regulatory Purposes:

Determining the right value of the intangible asset for transfer pricing, taxation, taxation for mergers and acquisitions, etc. If we don’t know the exact cost of an asset, how will we calculate the profit earned from it if we sell the same asset? - Improving Accuracy and Reliability of Financial Communication:

Informing stakeholders (management, employees, shareholders, regulators, etc.) is of paramount importance in today’s scenario. - Improving and Diversifying Access to Finance:

Recognizing the worth and inherent value of intangible assets would improve the chances of applying for financing. Funding is a serum that gives life to an organization. Fund Investors would like to know the true picture of the financials before making any investment. - Impairment Testing:

It compares an asset’s carrying amount in the balance sheet with its recoverable amount. - Gaining the Competitive Edge:

An increase in intangibles investment may trigger an increase in total factor productivity and therefore long-term economic growth. For example, many times the buying of patented software helps the companies to increase productivity.

Common Intangible Assets:

Intangibles can be of various natures and types but a broad bifurcation is given below:

Marketing-related intangible assets

- Trade marks (eg. Reliance symbol, Nike logo)

- Internet domain names (eg. www.google.com, www.yahoo.com)

- Non-competition agreements

Customer-related intangible assets

- Customer lists (eg. Tata Motors’ database of clients)

- Customer contracts (eg. Apple’s contracts with customers)

- Customer relationships

Artistic-related intangible assets

- Plays (eg. The Lion King play)

- Books (eg. Harry Potter books)

- Pictures (eg. Van Gogh’s paintings)

Contract-based intangible assets

- Licensing, royalty agreements (eg. Lending a license for use)

- Leasing agreements (eg. Leasing agreement to use an asset)

- Broadcasting rights (eg. Hotstar’s right to broadcast IPL)

Standard on Valuation of Intangible Assets under IVS 210

- The standard broadly prescribes the methods and various ways by which Intangible Assets shall be valued.

- Intangible assets should be able to generate quantifiable economic benefits for the company. They can either be purchases or developed internally. Common examples these assets are patents, computer software, trademarks, copyrights, and brands.

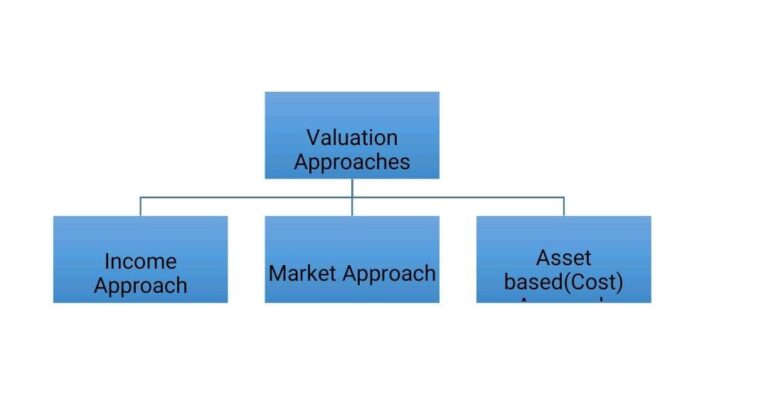

- The standard prescribed the following three approaches which are mentioned in IVS 105 for valuation of intangibles:

Market Approach:

Market-based approach to Intangible Asset valuation attempts to establish their value by comparing to similar Intangible Assets that have been recently sold or transacted.

It can be applied only when there is an active market for the intangible. This means that the intangible asset should have readily available buyers and sellers. A lot of time IA are unique to the specific organizations they exist and even though they may be valuable to their respective organizations, they do not have buyers in the market. For example, formula for vaccines of specific medicines even though is quite valuable, there may not be many similar companies using the same type of formula or manufacturing medicines for such diseases.

Information about price in arm’s length transactions should be available: In cases of transactions involving IA, it is quite common to have buyers and sellers who are related parties. This affects the price of the IA and as such types of transactions cannot be considered when valuing a similar IA.

The only method that can be used under the market approach is the Guideline Transaction Method.

Income Approach:

Valuation under the Income Approach is dependent upon:

(i) inflows in the business in the form of net profit/gross inflow and

(ii) funds used to earn income in equity and debt funds, etc.

This approach depends upon past/expected normalized free cash flow to the company and/or equity (FCFF/FCFE). Under various methods, the projected cash flows are used with statistical techniques. Discount factors reflect the value of time, money, the risk involved, etc.

Valuation of IA using this approach involves the excess income generated using the IA or cost saved by applying the IA.

There has to be a reasonable measure of forecasting excess income earned or cost saved.

Some of the commonly used methods in this approach are given below:

a. Excess Earnings Method:

The excess earnings method determines the value of an intangible asset as the present value of the free cash flows which are directly linked to the IA to be valued. All other proportions of the cash flow attributable to different assets are excluded. It is often used for valuations where there is a requirement for the acquirer to allocate the overall price paid for a business between tangible assets, identifiable intangible assets, and goodwill.

b. Relief-from-Royalty Method:

Under this method, the value of an intangible asset is determined by calculating a hypothetical royalty payment value. That would be saved by owning the asset compared to licensing the intangible asset from a third party. The hypothetical royalty payments over the life of the intangible asset are adjusted for tax and discounted to present value at the valuation date.

c. Premium Profit Method or With-and-Without Method:

This method is sometimes referred to as the with-and-without method. It indicates the value of an intangible asset by comparing two situations: The profit of the business in which it uses the subject IA and one in which the business does not use the subject IA, with all other factors remaining the same.

Cost Approach:

The cost approach indicates value using the economic principle that a buyer will not pay more for an IA than the cost to obtain an IA of equal utility, whether by purchase or by construction, unless undue time, inconvenience, risk, or other factors are involved.

Generally, the cost approach should be used as the primary basis for the valuation of intangible assets only if the following criteria are met:

(a) it would be possible for market participants to recreate an intangible asset of similar utility to the subject asset,

(b) there are no legal protections (eg, patents, trademarks) or other barriers to entry (eg trade secrets). This prevents market participants from recreating an asset of similar utility or profiting from such a recreated asset, and

(c) the intangible asset could be recreated quickly enough that a market participant would not be willing to pay a significant premium for the ability to use the subject asset immediately.

The commonly used method under this approach is replacement

cost and reproduction cost. However, many intangible assets do not have physical forms that can be reproduced. Assets such as software that can be reproduced generally derive value from their function/utility rather than their exact lines of code. As such, the replacement cost is most commonly applied to the valuation of intangible assets. Simply explained the value of an IA is affixed at the cost of replacing the IA with a similar one either by purchasing or building it.

Conclusion:

The old saying that “joh dikhta hai who bikta hai” means that what can be seen can be sold is now a passe. With more and more technology-based companies entering the scene the role of IA valuations is becoming increasingly important.

Disclaimer

The content published on this blog is for informational purposes only. The opinions expressed here are solely those of the respective authors and do not necessarily reflect the views of Fintrac Advisors. We make no warranties about the completeness, reliability, and accuracy of this information. Any action you take based on the information presented on this blog is strictly at your own risk, and we will not be liable for any losses and damages in connection with the use of our blog. We recommend seeking professional expertise for any such work. External links on our blog may lead to sites that are not under our control, and we are not responsible for the nature, content, and availability of those sites.