FOREIGN OWNED/ CONTROLLED COMPANY (FOCC)

Neeraj Agarwal

I Neeraj Agarwal, am a Fellow Member of ICAI, practicing under the banner of M/s AAN & Associates LLP, a firm based out of Banglore Mumbai.

I am also registered under Insolvency and Bankruptcy Board of India as a Registered Valuer for valuation of Security or Financial Assets (Passed in Feb 2020)

I am also holding Bachelor of Commerce (B. Com) degree from Calcutta University (Passed in 2011).

I have corporate working experience in Wipro. After working in Wipro for a short period I started my practice in late 2013 and have been in practice so far for the last 10 years. I have also completed a Certificate Course by ICAI on IND-AS in 2020. I have also cleared Social Auditor Exam conducted by NISM.

I have been inducted as a Special Invitee to the Sustainability Reporting Standard Board, ICAI for the FY 2023-24.

Introduction

Foreign Owned or Controlled Companies or FOCCs are familiar names for Indian subsidiaries or entities controlled by non-resident/ foreign or multinational companies. FOCC is an Indian company set up, owned, or controlled by a non-resident/foreign company or MNC (hereinafter referred to as the parent company). FOCC is a great source of investment for companies who wish to invest and have a controlling interest and ownership in the investee or even want to conduct business operations in India as a domestic company. A foreign company conducts business operations in India but with the status of a foreign company which holds them back from the benefits of domestic companies. As a result, many companies prefer to incorporate an FOCC to enjoy the benefits of a domestic company like Disney India, Star India, etc.

Guidelines for Incorporation

Certain compliances are needed to be adhered to at the time of obtaining ownership/ control. Companies Law and Foreign Exchange Management Law (FEMA) are two major laws that govern the process. Companies Law governs the whole incorporation process and FEMA governs the investment-related procedures. The incorporation process is the same as that of a domestic company except for some additional requirements, for example, the requirement of having at least one Indian director out of two directors if the FOCC is a private limited company. The documents provided by the foreign director should be in English and apostille.

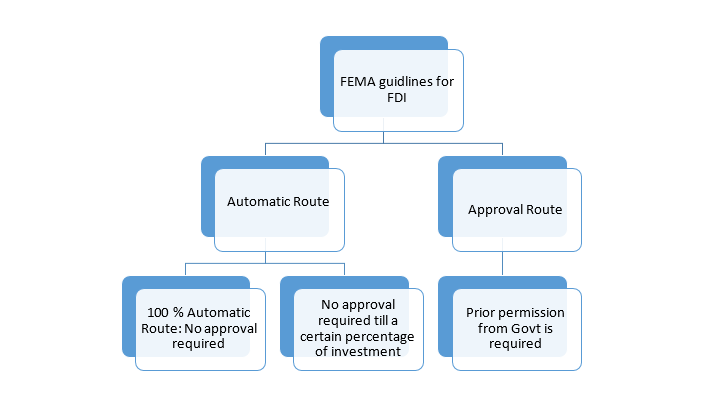

As said earlier, due to investment from foreign countries FEMA acts as a strict watch guard. Before investing, one has to consider certain regulations like sectoral cap, routes of entry, allowed and prohibited sectors, etc. One cannot invest in any sector, in any proportion, in any manner as he or she prefers. There is an exhaustive list of sectors from each point of view. Let us understand this with the help of an example.

For example- Nuclear Power is one of the prohibited sectors where Foreign Investment is not allowed. If a parent company wishes to set up a nuclear power plant in India and for that it is forming a company, it is strictly prohibited.

There are certain sectors where a certain percentage of foreign investment is allowed but after that, they become prohibited. Entities in the Digital Media sector are allowed to have foreign investment of a maximum of 26%. So a foreign company cannot invest in a domestic company beyond the limit of 26% in this sector. Beyond that, it also becomes a prohibited sector. Taking digital media, the investment of 26% needs approval from the government (which means it comes under the approval route and not the automatic route).

There are some sectors where automatic approval is there for a certain limit, then one needs to get approval from the government and after that, it becomes prohibited. Entities in private sector banking can have 49% auto investment, above 49% to 74% with government approval, and beyond that, it is prohibited.

Different Types of FOCC

Knowing about the pre-conditions we can now move towards the types of FOCC. FOCC can be set up as a joint venture as well as a Wholly- Owned Subsidiary (WOS). WOS can be set up by the parent company only for sectors where 100% foreign investment is allowed under automatic route and none other than that. Joint ventures can be set up in sectors where FEMA regulations permit them to do so. A parent company can also acquire equity instruments (instruments like equity shares, compulsorily convertible preference shares, and debentures) in an existing company and make the latter a FOCC.

The procedure and compliances for all three are different.

For setting up a WOS-

First, the company needs to be incorporated in India. The process is quite similar to the incorporation of a Non-WOS. The parent company has to nominate one director through a resolution who will represent the parent in the functioning of WOS ( The nominated director can be an Indian or foreign national). There also needs to be a second director who has to be mandatorily Indian if the first director is not an Indian citizen. After incorporation, subscription money has to be received from the parent company, and a Foreign Inward Remittance Certificate (FIRC) along with the KYC of the foreign investor needs to be collected from the Authorized Dealer Category I banks. Then the company needs to file FC- GPR (Foreign Currency- Gross Provisional Return) for approval from RBI.

For setting up a joint venture-

There are two alternative methods for this:

- If a sector is under automatic route then the same process as that of WOS has to be followed.

- If a sector is under the approval route additionally, prior approval has to be taken from the government after which the subscription money can be brought into India.

For acquiring equity instruments in an existing company-

There are two methods of acquiring an interest in an existing company. The first one is the transfer of equity instruments and the other one is the issue of new shares. As in most cases, there will be a transfer of equity instrument, so Foreign Currency- Transfer of Shares (FC-TRS) needs to be filed with RBI. But if new shares are issued, the domestic company needs to file FC- GPR along with statutory requirements of Companies Law.

Process for obtaining approval-

Department of Industrial Policy & Promotion (DIPP) along with the concerned sector ministry manages the approval process of Foreign Direct Investment (FDI) from the FDI portal- Foreign Investment Facilitation. An application has to be submitted as a proposal along with the documents required on the portal. If the application is not digitally signed, then a copy of the application has to be submitted physically also. DIPP sends the application to the concerned ministry and RBI within two days of receiving it. The ministry can ask for any additional information required and DIPP has to clarify within 15 days of receiving it from the applicant. After receiving the required information, the decision is communicated within 2 weeks. In cases where security clearance is required like investment from countries of concern like Pakistan or Bangladesh, Union Home Ministry is to be communicated and its approval is also required. If the investment amount exceeds INR 5000 Crore, the Cabinet Committee of Economic Affairs is to be involved. If the proposal is to be rejected by the concerned ministry, DIPP has to be consulted.

Process for reporting of funds received-

Whether funds are received through a direct route or an approval route, the domestic company is required to report to the RBI about the receipt of funds. This is done through the AD bank through which the funds have been received by reporting in FC-GPR containing details like name and address of parent company, date of receipt of fund, rupee equivalent, etc.

Process for filing FC- TRS

RBI has introduced a special portal Foreign Investment Reporting and Management System (FIRMS) in which it has subsumed multiple forms for foreign investment. For filing of the form, registration has to be made on the portal. Two types of registration have to be availed, i.e., Entity User and Business User. The onus of filing remains with the resident of India, whether transferor or transferee, but if the shares are acquired from the stock exchange by the parent company, then, it has to fill the form. Some of the details that are required to be filled are: investment details like CIN, PAN number; particulars of transfer like type and face value of securities; remittance details like mode of payment, and name of AD Bank. Some attachments are also required which are different in case of gift and sale. In the case of gift, name, and address of donor and donee; the relation between them; reason needs to be attached. In case of sale,a consent letter for transfer/ receipt of consideration, and shareholding pattern of the company before and after acquisition by the person resident outside India needs to be attached.

Process for filing FC- GPR

FC- GPR, filed through the FIRM’s portal of RBI is used when equity instruments are issued by a domestic company to a person or entity resident outside India. The onus of filing is with the domestic company within 30 days of allotment of the instrument. Some of the details are pre-filled due to the registration and some have to be filled. Details of the investee company are pre-filled in like CIN, company name, and PAN details. Details that are required to be filled are: FDI details, Issue details, details of Foreign Investors, details of Amount of Issue, Particulars of Issue, Shareholding pattern, etc.

FDI details: entry route, applicable sectoral limitIssue

details: date of issue, nature of issue Details of Foreign

Investor: general details like name, address, country of residence

remittance details like name & address of AD bank, mode of payment, FIRC no.

Details of the amount of issue: the total amount of inflow and the amount for which equity instrument issued

Particulars of Issue: type of capital instrument, number and issue price of such

Shareholding pattern: pre-transaction value is auto-calculated and post-transaction value is calculated based on the particulars of the issue provided.

Valuation Requirements

In the case of FOCC, valuation requirements may arise in the following scenarios:

❖ If incorporating a FOCC:

- Companies Act: No requirement for Valuation

- Income Tax Act: Valuation requirements as per relevant section from a Practicing Chartered Accountant (Non-DCF method) or from a Merchant Banker (Any method)

- FEMA guidelines: Valuation by a Practicing Chartered Accountant/ Cost Accountant or a Merchant Banker may be required under FEMA guidelines for filing FC-GPR

❖ If acquiring capital instruments of a FOCC:

If the existing shares of a company are being bought from a shareholder, then the following needs to be taken:

- Companies Act: No requirement for Valuation

- Income Tax Act: Valuation requirements as per relevant section from a Practicing Chartered Accountant (Non-DCF method) or from a Merchant Banker (Any method)

- FEMA guidelines: Valuation by a Practicing Chartered Accountant/ Cost Accountant or a Merchant Banker required under FEMA guidelines for filing FC-TRS

❖ If the fresh issue of shares is being done:

- Companies Act: Valuation to be done by a Registered Valuer

- Income Tax Act: Valuation requirements as per relevant section from a Practicing Chartered Accountant (Non-DCF method) or from a Merchant Banker (Any method)

- FEMA guidelines: Valuation by a Practicing Chartered Accountant/ Cost Accountant or a Merchant Banker may be required under FEMA guidelines for filing FC-GPR

Annual Compliances

FEMA guidelines:

Annually form FLA (Foreign Assets and Liability) is required to be filed. It covers details of all foreign holdings in the company whether it is a FDI (Foreign Direct Investment) or FPI(Foreign Portfolio Investment). It also covers details about ODI(Overseas Direct Investment) made by the company, if any.

Income Tax

Apart from the usual annual returns, FOCC is needed to file a Transfer Pricing Report(Form 3CEB) with the Income Tax Authorities in case of specified transactions with its foreign Associated Enterprises. This involves getting these transactions audited by a Practicing Chartered Accountant.

Companies Act

Along with the usual compliance requirements, a foreign company must file eForm FC-3 (Annual accounts along with the list of all principal places of business in India established by the foreign company) and E form FC-4(Annual Return).

Disclaimer

The content published on this blog is for informational purposes only. The opinions expressed here are solely those of the respective authors and do not necessarily reflect the views of Fintrac Advisors. We make no warranties about this information’s completeness, reliability, and accuracy. Any action you take based on the information presented on this blog is strictly at your own risk, and we will not be liable for any losses and damages in connection with the use of our blog. We recommend seeking professional expertise for any such work. External links on our blog may lead to sites that are not under our control, and we are not responsible for the nature, content, and availability of those sites.