KSA – E-Invoicing & Opportunities for Indian Firms

Navneet Agrawal

Navneet Agrawal is a CA and a LLB graduate by qualification. Having more than 12 years of experience in Indirect taxation, Navneet has worked across industries in multiple sectors like Retail, Automotive, FMCG, Indutrial manufacturing, AlcoBev, etc. helping these clients in their tax related matters. His area of specialisation includes successful implementation of GST, E-Invoicing in India & KSA, technology development/enhancements, litigations, advisory, etc.

What is E-Invoicing?

Colombia– “The electronic invoice is the evolution of the traditional paper invoice. For legal purposes, it has the same validity as paper, however, it is generated, validated, issued, received, and stored electronically”

Saudi Arabia– “A tax invoice generated in a structured electronic format through electronic means”. New Zealand– “Is the direct exchange of data between any 2 accounting systems, that makes doing business smoother, faster, and safer “.

India “E-invoice is a system in which B2B invoices are authenticated electronically by GSTN for further use on the common GST portal.

Where did E-Invoicing Start?

- Beginning of the Electronic invoicing process in Latin American countries – 2004

- COLOMBIA- The concept of e-invoicing was introduced in 1995 in MEXICO

- Introduction of CFD for e-invoicing – 2014

- COSTA RICA- Pilot project for e-invoicing begins – 2019

- DOMINICAN REPUBLIC- Pilot project for e-invoicing launched – 2002

- ARGENTINA-The validity of the e-invoicing as a duplicate receipt was established – 2010

- PERU- Pilot project for e-invoicing begins – 2016

- PANAMA- Launch of the Panama e-invoice system (SFEP) with a voluntary pilot plan – 2018

Why is there a need for E-Invoicing?

- Real-time tracking of invoices

- Reduction in data entry errors

- Curb tax evasion

- Faster payment and improved cash flow

- Reduction of invoice processing costs

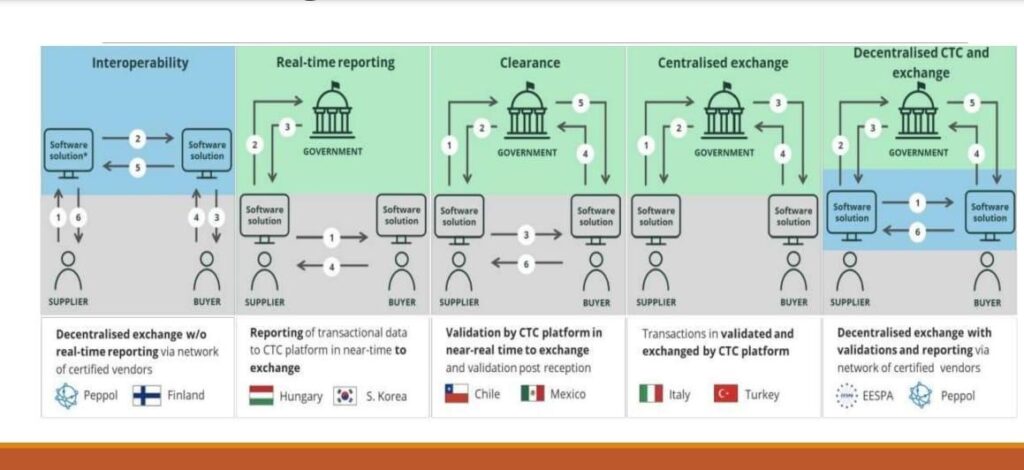

E-Invoicing Models

E-Invoicing in KSA

E-Invoicing & KSA Timelines

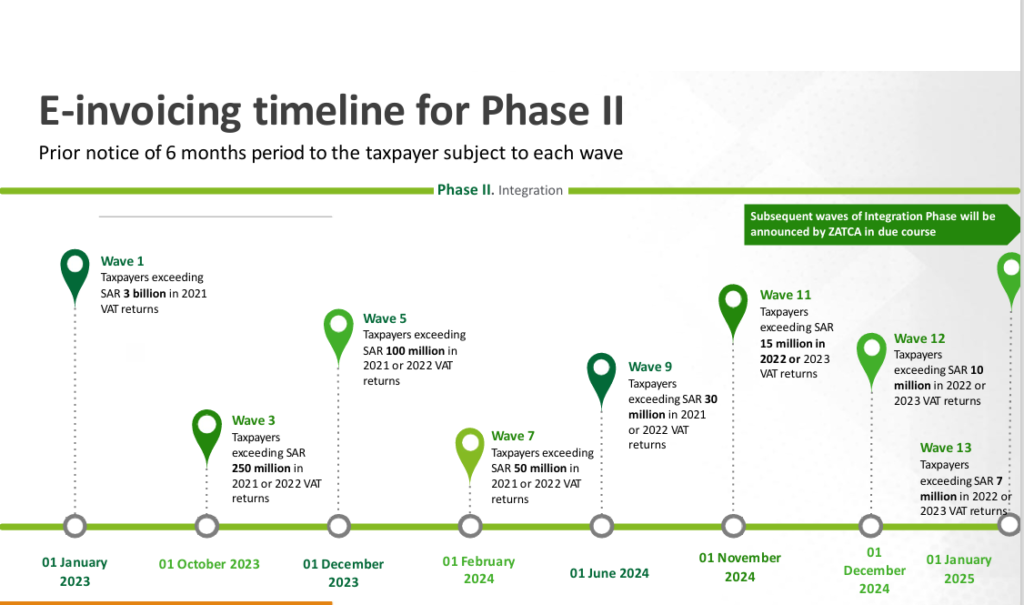

ZATCA has adopted a phased approach to implement e-invoicing in the Kingdom:

Phase I: Generation, Issue, and Storage

- 17 September 2020: Issuance of draft regulations

- 04 December 2020: Issuance of final regulations

- 28 May 2021: Final requirements from ZATCA

- 1 October 2021: Further clarifications for the generation, issue, and storage phase go live

- 4 December 2021: Generation, issue, and storage phase go live

Phase II: Integration

- 1 June 2022: Detailed API and security clarification update for the integration phase go live

- 1 January 2023: The integration phase goes live

E-invoicing and its scope Transactions subject to E-invoicing

- Supplies of taxable goods and services (i.e., standard VAT rate or zero rate)

- Export of goods and services from the Kingdom

- Intra-GCC supplies

- Nominal supplies by the taxable person

- Any Payments related

Transactions not subject to E-invoicing

- Supplies are fully exempted from VAT.

- Any payments related to supplies fully exempted from VAT and received by a taxable person before such supply.

- Supplies are subject to VAT according to the Reverse Charge Mechanism.

- Import of goods to the Kingdom.

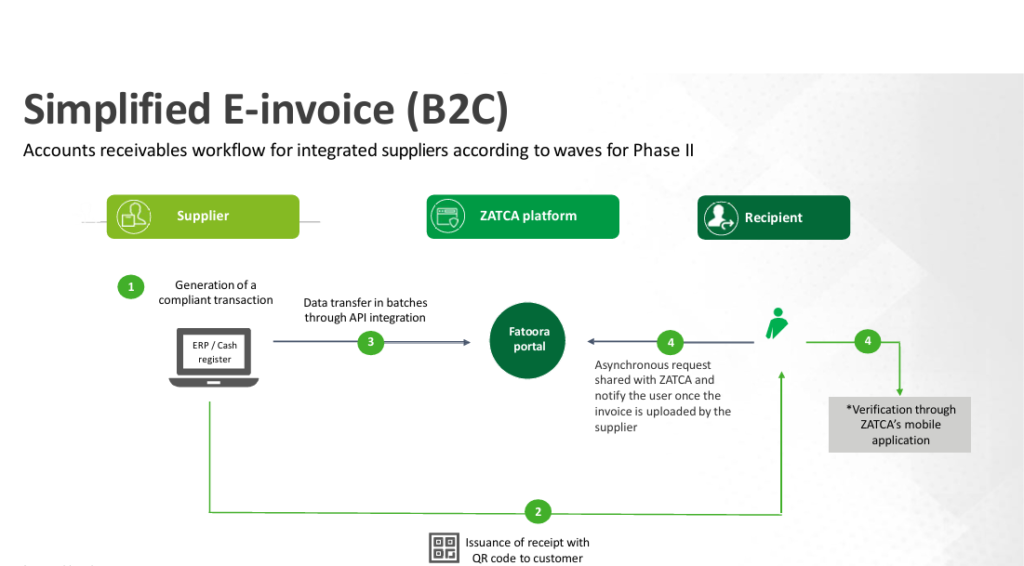

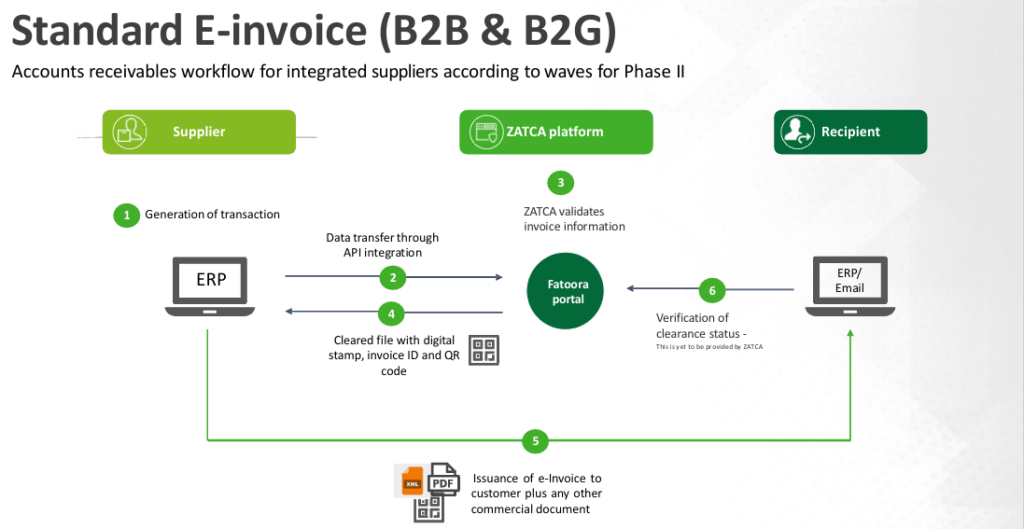

E-Invoicing Models in KSA

Impact of E-Invoicing on Businesses

- E-invoicing impact on the business landscape

1. Impact

2. Contracts

3. Vendor and Customer communication

4. Transactions Identification

5. Change management

6. Arabic language/ Master data

7. Cash Flow Impact

8. People

9. Technology

10. Tax reporting

11. Archiving.

E-invoicing and the Key Challenges

Key Challenges

- Ever-changing tax environment & regulations

- Integration Issues: E-invoicing systems’ integration with existing accounting and ERP systems

- Security and Privacy: Protecting the confidentiality and integrity of invoicing data

- Standardization: Interoperability between different e-invoicing systems can be a challenge (different taxpayers in various phases)

- User Adoption: Training and convincing users to switch from traditional paper invoicing to an electronic system

- Technology Constraints: Businesses must ensure appropriate technology and infrastructure

- Costs of Implementation: The initial costs of implementing an e-invoicing system can be high (i.e., purchasing software, hardware, and training)

Opportunities for Indian Firms

- Help companies in E-Invoice implementation (Advisory & Technical assistance)

- Help companies in VAT Compliances, Advisory & Controversies

- E-Invoicing opportunities in GCC countries (Next is UAE)

- Corporate tax opportunity in UAE