Lost Your GST Registration? Steps to Get It Back Quickly

CA Navin Singhal

CA Navin Singhal is a versatile professional with diverse experience in various fields, including:

– Valuation expertise in Insolvency and Bankruptcy cases as a junior valuer

– Statutory audit of listed and unlisted companies

– Stock and receivable audit

– Leadership role in internal audit teams

– GST audit for individuals and companies

His broad range of experience has equipped him with a unique understanding of various aspects of accounting, auditing, and valuation.”

Overview: GST Cancellation is the prerequisite for terminating GST Registration, as the name suggests. GST cancellation can occur for several reasons, such as company closures, the inapplicability of GST regulations, and many more. Businesses may eventually need to reactivate a GST registration that has been canceled or rendered inactive.

For businesses, losing your GST registration can be a major setback that affects your ability to produce compliant invoices, file returns, and receive input tax credits. But it is possible to restore it. We’ll show you how to effectively revive your canceled GST registration in this article. To improve your chances of success, remember to pay off all outstanding debts and submit all unfiled returns.

Important Points

- When GST is canceled, the registration becomes dormant; you are unable to claim input tax credits, issue compliant invoices, or collect tax.

- Eligibility for revocation requires adherence to GST regulations and the payment of all outstanding balances before the application, typically within ninety days of cancellation.

- Be thorough and, if necessary, seek professional assistance, as improper documentation and missed deadlines are common issues during the revocation process.

What is the Cancellation of GST?

The revocation of GST registration is known as GST cancellation. The Goods and Services Tax Identification Number (GSTIN) gets deactivated as a result. This may occur for several reasons, such as a business closing, the GST regulations not being applicable, or a request from a tax official. You are informed that your status is changed to “Inactive,” and you are unable to upload invoices or file returns when a GST registration is canceled.

Your company may suffer greatly as a result of this deactivation. You are unable to collect GST, generate invoices that comply with GST, or claim input tax credits on your purchases if your GST registration is not active. Your business operations may be disrupted, and continued operations without resolution could result in severe penalties.

You may be eligible for revocation, though, if the tax authorities cancel without following the proper procedures. The first step in revoking GST cancellation is to understand the process. You can better prepare for the procedures to reactivate your GST registration if you are aware of the reasons behind the cancellation and the immediate effects.

Revocation of GST Cancellation Eligibility

You must be aware of the requirements if you intend to apply for revocation of your GST registration.

- To overturn a cancellation made by tax authorities, the required paperwork and legitimate justifications must first be shown.

- Your submission should include a thorough justification of your request for revocation.

- You must demonstrate compliance with GST regulations before cancellation to be eligible for revocation.

- Prior to applying, all outstanding taxes and penalties must be paid. In the event that cancellation resulted from failure to file returns, such returns must be filed and any outstanding balances paid before requesting revocation.

Your chances of a successful revocation will rise if you adhere to these requirements.

Time Limit for Applying for Revocation

It is important to note the time restriction for the revocation of a canceled GST registration. As of October 2023, taxpayers can request revocation within ninety days of the cancelation order date. You should take action as quickly as possible, ideally within 30 days after receiving the cancellation letter, to prevent issues. Furthermore, no registration should be inactive for longer than three years. If these deadlines are missed, rejection may occur automatically.

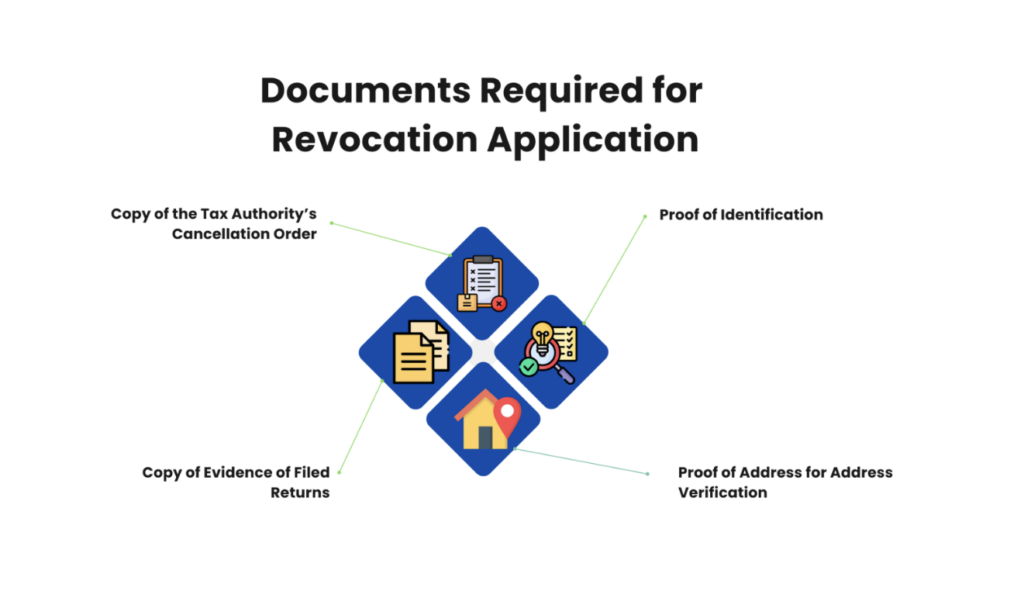

Documents Required for Revocation Application

To support your application, you need to provide several documents:

- Copy of the Tax Authority’s Cancellation Order

- Proof of Identification

- Proof of Address for Address Verification

- Copy of Evidence of Filed Returns

These documents demonstrate adherence to GST regulations. Inadequate, inaccurate, or improper documentation may result in application delays or even rejection. As a result, care must be taken when compiling the paperwork and submitting applications with the required information.

Steps to Reactivate Your Canceled GST Registration

To guarantee a seamless process, there are a few stages involved in reactivating your GST registration that need to be properly followed.

Step 1: Access the GST Portal and login.

- Go to the GST Portal: Enter your GSTIN and password to access the official GST portal. Choose the “Forgot Username” or “Forgot Password” options to retrieve your login credentials if you’ve forgotten them.

- Select ‘Registration’ under the ‘Services’ page, then ‘Application for Revocation of Cancellation’ to access the Revocation Application.

Step 2: Request Cancellation Revocation

- Complete Form GST REG-21: When an officer cancels a GST registration, this form is used. Provide the reasons for the revocation request together with your GSTIN. You can attach supporting documentation.

- Submit the Application: Apply after confirming the details with an Electronic Verification Code (EVC) or Digital Signature Certificate (DSC).

Step 3: Submit Every Outstanding GST Return

- Clear the Backlog: Submit all outstanding GST returns from the time your registration remained dormant.

- Pay Taxes, Penalties, and Interest: Kindly make the necessary payments for the taxes, interest, and penalties that are owed for these periods.

Step 4: Send in the necessary paperwork

- Supporting Documents: Upload all required files, including a copy of the PAN card, proof of address, bank account details, and filed GST returns.

Step 5: Pay any applicable late fees and penalties.

- Calculate and Settle Penalties: Ensure that all outstanding late fees, interest, and penalties related to your canceled registration are paid in full.

Step 6: Answer Questions from the GST Department

- Keep an eye on the Portal: frequently check the portal for any notices or inquiries from the GST division.

- To prevent processing delays, please be sure to respond promptly.

Step 7: Approval for Reactivation

- GST Department Review: The GST department will examine your application after all conditions have been satisfied.

- Approval and Reinstatement: Your GSTIN will be restored if the authorities grant your request to revoke it, provided that everything is in order.

The Repercussions of Not Removing the GST Cancellation

There may be severe repercussions if a canceled GST registration is not revoked. Tax authorities may slap heavy penalties. Profits suffer as businesses are no longer able to claim input tax credits. It is against the law to operate without an active GST registration, and doing so may result in further penalties. Beyond just having a financial impact, businesses may be disrupted by the inability to generate GST bills and a loss of trust. Continuous cancellation can undermine stakeholder trust and harm your company’s reputation. Promptly addressing GST cancellation helps prevent such negative consequences.

Typical Errors to Avoid in the GST Cancellation Revocation Procedure

In the process of revocation, many taxpayers make mistakes. Incomplete documentation submission is a frequent mistake that causes delays in the process’s completion. Make sure to include all necessary paperwork, such as Form GST REG-21 and any supporting documentation.

Ignoring the application deadlines is another frequent error. Your GST registration may be permanently canceled as a result. You can navigate the complexities and steer clear of common blunders when revocation of canceled GST by seeking professional advice.

Compliance Following Reactivation

Following reactivation, strict adherence to GST regulations is essential. Filing proper and timely GST returns is essential to preventing penalties and cancellations in the future. For continued compliance, accurate records of purchases, sales, and input tax credit claims are essential. Heavy fines, the loss of input tax credits, and an increase in tax liabilities can result from noncompliance. Tax experts can assist companies in comprehending and putting into practice efficient compliance plans. Maintaining compliance with GST regulations is facilitated by periodic reviews of compliance procedures.

Conclusion

Following the preceding instructions and paying close attention to detail is necessary when reactivating a canceled GST registration. You can effectively recover your GST registration by adhering to these instructions and making sure that any outstanding returns and tax obligations are paid. Please keep in mind that taking prompt action is essential to preventing more issues and guaranteeing the continuous operation of your company.

Disclaimer

The content published on this blog is for informational purposes only. The opinions expressed here are solely those of the respective authors and do not necessarily reflect the views of Fintrac Advisors. No warranties are made regarding the completeness, reliability, or accuracy of this information. Any action taken based on the information presented in this blog is strictly at your own risk, and we will not be liable for any losses or damages resulting from its use. We recommend seeking professional expertise for any such work. External links on our blog may direct users to third-party sites beyond our control. We do not take responsibility for their nature, content, or availability.