Recent Changes in International Valuation Standards (IVS) Effective January 31, 2025

Neeraj Agarwal

I Neeraj Agarwal, am a Fellow Member of ICAI, practicing under the banner of M/s AAN & Associates LLP, a firm based out of Banglore Mumbai.

I am also registered under Insolvency and Bankruptcy Board of India as a Registered Valuer for valuation of Security or Financial Assets (Passed in Feb 2020)

I am also holding Bachelor of Commerce (B. Com) degree from Calcutta University (Passed in 2011).

I have corporate working experience in Wipro. After working in Wipro for a short period I started my practice in late 2013 and have been in practice so far for the last 10 years. I have also completed a Certificate Course by ICAI on IND-AS in 2020. I have also cleared Social Auditor Exam conducted by NISM.

I have been inducted as a Special Invitee to the Sustainability Reporting Standard Board, ICAI for the FY 2023-24.

As a chartered accountant, staying updated with the latest changes in International Valuation Standards (IVS) is crucial for ensuring compliance and maintaining the integrity of financial reporting. The International Valuation Standards Council (IVSC) has announced significant updates that will take effect on January 31, 2025. This blog post will explore the number of IVS, the specific changes made in each standard, and which International Valuation Standards have been altered in 2025.

Understanding International Valuation Standards (IVS)

Before we dive into the changes, let’s clarify what IVS are. The International Valuation Standards are a set of guidelines that provide a framework for valuing assets and liabilities. These standards are essential for ensuring consistency and transparency in valuation practices across different jurisdictions.

Key Updates in IVS 2025: What Valuers Need to Know

The International Valuation Standards Council (“IVSC”) published the revised International Valuation Standards (“IVS”) on January 31, 2024. These revised standards, referred to as “IVS 2025,” will be effective from January 31, 2025, for valuations performed on or after that date, with early adoption permitted from January 31, 2024. A review of the red-line version of IVS 2025, along with the Basis for Conclusions outlining the rationale behind most of the changes, highlighted several important updates.

NEW STRUCTURE

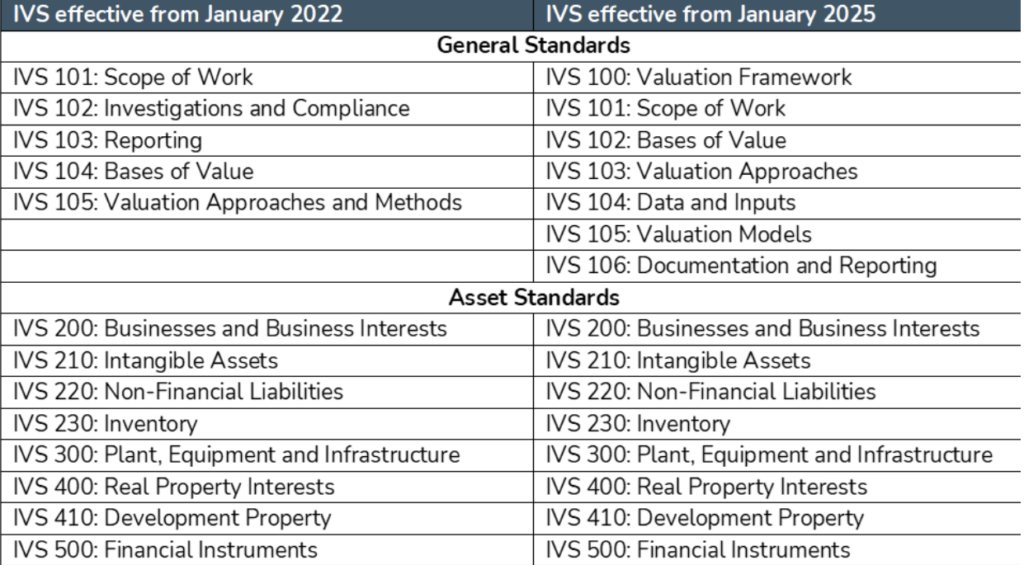

Fig. 1: As seen above, there have been significant changes to the general standards compared to the asset standards, while the overall framework largely remains the same.

Key Changes in IVS Effective January 31, 2025

The IVSC has made several important updates to the IVS, which are designed to enhance clarity, improve consistency, and address emerging valuation challenges. Here’s a breakdown of the changes:

IVS 100: Valuation Framework

1. Valuation Process Quality Control

IVS 2025 mandates that valuers establish quality controls to ensure objective, transparent valuations free from bias and in compliance with IVS. While IVS 100 initially outlined the need for these controls, it did not provide detailed guidance on how they apply across different valuation practices. The Basis for Conclusions suggests that valuation professional organizations may issue specific guidance on the implementation of these quality controls.

2. Use of a Specialist or Service Organization

IVS 2025 introduces a significant update, allowing valuers to outsource aspects of a valuation where they lack the necessary technical skills, data, or knowledge. This requires agreement with the client and proper disclosure. The valuer is responsible for assessing and documenting the capabilities of the specialist or service organization. They must fully understand their process and findings before relying on their work. This update applies across both the general and the asset standards.

IVS 101: Scope of Work

Changes Made:

1. Expanded Definition of Scope of Work

The scope of work now explicitly includes all fundamental terms of a valuation or valuation review, such as:

- The asset(s) or liability(ies) being valued.

- Intended use and users of the valuation.

- Responsibilities of the parties involved.

2. Minimum Requirements for Scope of Work

The updated IVS 101 mandates that the scope of work must specify:

- Type of valuation or review being conducted.

- Identity of the client and intended users.

- Asset(s) or liability(ies) being reviewed.

- Intended use and significant assumptions or limitations.

- Procedures to be undertaken and documentation to be reviewed.

3. Enhanced Reporting Alignment

- IVS 101 Scope of Work and IVS 106 Documentation and Reporting now include separate scope of work and reporting requirements for valuations and valuation reviews.

IVS 102: Bases of Value

1. Introduction of Premises of Value

The concept of “premises of value” has been elaborated upon, describing how assets and liabilities are utilized under different scenarios. Common premises include:

- Highest and Best Use: The most profitable legal use of an asset.

- Current Use/Existing Use: The value based on how the asset is currently utilized.

- Orderly Liquidation: The sale of an asset in a manner that maximizes value over time.

- Forced Sale: The sale under duress, typically resulting in a lower price.

2. Synergies Consideration

- The updated standard includes a section on synergies, which refers to the additional value derived from combining assets or operations.

- It clarifies that synergies should only be considered if they are available to other participants in the market, ensuring objectivity in valuations.

3. Inclusion of ESG Considerations

- Recognizing the growing importance of Environmental, Social, and Governance (ESG) factors in valuation, IVS 102 encourages valuers to consider these aspects when determining bases of value.

4. Appendix Updates

- The appendix has been revised to include detailed definitions and descriptions of various bases of value, such as market value, investment value, fair value (IFRS), and others.

- This section serves as a quick reference for valuers to understand the implications and applications of each basis.

IVS 103: Valuation Approaches

1. Integration of ESG Factors

- A significant update in IVS 103 is the explicit incorporation of ESG criteria into the valuation approaches.

- Valuers are now directed to consider ESG factors alongside traditional valuation elements such as size, quality, and material characteristics when assessing comparable transactions.

2. Enhanced Guidance on Data Inputs

- While IVS 104 (Data and Inputs) primarily addresses data quality, IVS 103 emphasizes the need for valuers to utilize reliable and relevant data inputs across all valuation approaches.

- The standard encourages valuers to maximize observable data to ensure accuracy and credibility in their valuations.

3. Documentation Requirements

- Although specific documentation requirements are primarily covered in IVS 106 (Documentation and Reporting), IVS 103 reinforces the importance of maintaining comprehensive records that justify the chosen valuation approach and any assumptions made during the process.

IVS 104: Data and Inputs

- Within the General Standards, a new chapter, IVS 104, has been added that deals with data and inputs. According to the standard, a valuation should maximize the use of “relevant and observable” data. Observable data is defined as “information that is readily available to market participants about actual events or transactions that are used in determining the value for the asset and/or liability.”

IVS 105: Valuation Models

- Earlier discussed briefly in Section 90 of the predecessor IVS 105: Valuation Approaches and Methods, the topic of valuation models is now housed in the revised IVS 105. The standard expands on various aspects related to valuation models, such as the characteristics of appropriate models and the factors influencing their application.

- Valuation models include the following statement: ‘No model, without the valuer applying professional judgment—for example, an automated valuation model (AVM)—can produce an IVS-compliant valuation.’ This addition to IVS 105 reflects the Board’s intention to identify AVMs as useful tools that assist valuers in developing valuations. This implies that an AVM can be a supplementary tool but cannot be used on a standalone basis for a valuation to be IVS-compliant.

IVS 106: Documentation and Reporting

1. Minimum Reporting Requirements

IVS 106 now outlines eighteen minimum reporting requirements, an increase from the previous ten outlined in the old IVS 103 Reporting Standard. These requirements include:

- Identification of the valuer and client.

- Currency used for the valuation.

- Basis of value applied.

- Any limiting conditions affecting the valuation.

- Consideration of Environmental, Social, and Governance (ESG) factors.

2. Alignment with Other Standards

- The updated IVS 106 aligns more closely with other standards, such as the Australian Valuation Standard APES 225, while providing more comprehensive reporting requirements.

- This alignment helps ensure consistency across different jurisdictions and enhances the credibility of valuations.

Integration of Environment, Social and Governance

IVS 2025 introduces the concept of Environmental, Social, and Governance (“ESG”) in the General and the Asset Standards. In the glossary, ESG is defined as:

“The criteria that together establish the framework for assessing the impact of the sustainability and ethical practices, financial performance, or operations of a company, asset, or liability. ESG comprises three pillars: Environmental, Social, and Governance, all of which may collectively impact performance, the wider markets, and society.”

While IVS 2025 discusses ESG factors and emphasizes that valuers consider their measurable impact on valuation, it does not provide application guidance. As discussed in the Basis for Conclusions, the Board believes that the IVS are overarching principle-based standards and hence should not provide application guidance. Nevertheless:

- ESG remains a key topic and is included in the IVS 2025 Agenda.

- The IVSC has published multiple perspective papers that discuss the interplay between ESG and valuation.

Conclusion

The updates to the International Valuation Standards, effective from January 31, 2025, represent a significant step forward in enhancing the clarity and consistency of valuation practices. As a chartered accountant, it is essential to familiarize yourself with these changes to ensure compliance and maintain the integrity of your work. The revisions to the standards are a welcome step, aligning with current developments in the field. As the valuation profession continues to evolve, there is anticipation regarding how the valuation principles will apply to emerging, non-conventional industries that do not lend themselves to valuation using traditional financial metrics.

Disclaimer

The content published on this blog is for informational purposes only. The opinions expressed here are solely those of the respective authors and do not necessarily reflect the views of Fintrac Advisors. We make no warranties regarding this information’s completeness, reliability, and accuracy. Any action you take based on the information presented on this blog is strictly at your own risk, and we will not be liable for any losses and damages in connection with the use of our blog. We recommend seeking professional expertise for any such work. External links on our blog may direct users to third-party sites beyond our control. We do not take responsibility for their nature, content, or availability.