Understanding the Input Service Distributor (ISD) and ITC Distribution Under GST

Jagrit Tenani

CA Jagrit Tenani has emerged as a seasoned professional in the domains of Risk-Based Audit, SoP Formulation and Implementation, Internal Audit, Statutory Audit, and Goods and Services Tax (GST).

His experience in the Corporate Audit Department of ITC Ltd. encompassed him with a keen awareness of the critical role that stringent internal controls play in ensuring organizational excellence and compliance.

Introduction to Input Service Distributor

According to Section 2(61) of the CGST Act of 2017, an “Input Service Distributor” is an office of the supplier of goods or services, or both, that receives tax invoices issued under Section 31 regarding the receipt of input services and issues a prescribed document to distribute the credit of central tax, state tax, integrated tax, or union territory tax paid on the said services to a supplier of taxable goods or services, or both, that has the same Permanent Account Number as the said office.

Thus, an office of a firm that accepts tax invoices for input services and distributes the available input tax credit to other branch offices of the same business is referred to as an Input Service Distributor (ISD) under GST.

The Necessity of ISD

Businesses with significant shared expenses can use ISD mechanism. The facility aims to ensure a smooth flow of credit under GST and to simplify the credit utilization process for organizations.

Who Is a Distinct Person?

People with valid PANs are required by law to register in each state or union territory within 30 days of becoming liable. A single registration can be applied for by an individual for all units in the same state.

Business verticals within a state may, as an exception, be eligible for multiple GST registrations if they involve distinct risks, returns, and functions from other components. Consequently, under GST law, two divisions of the same company that seek separate registrations will be regarded as separate companies or individuals.

Each will be subject to different laws about return filing and other compliance processes. In general, different people can include:

- A business located in India and another located outside India

- A facility in one state or union territory and another in a different state or union territory

For instance, A (in Bangalore) will be regarded as a separate person or entity if it has branches in Germany and Maharashtra. Similarly, A and B will be separate entities if A has another component, B, that is different from A and has a separate GST registration.

The following requirements must be fulfilled to be registered as distinct persons:

- The organization must have multiple locations for operations or establishments.

- The entity should not be registered under the composition scheme.

- All separately registered places of business of such a person shall pay tax under the Act on the supply of goods or services or both made to another registered place of business of such person and issue a tax invoice or a bill of supply as the case may be, for such supplies.

The ITC Distribution Methodology

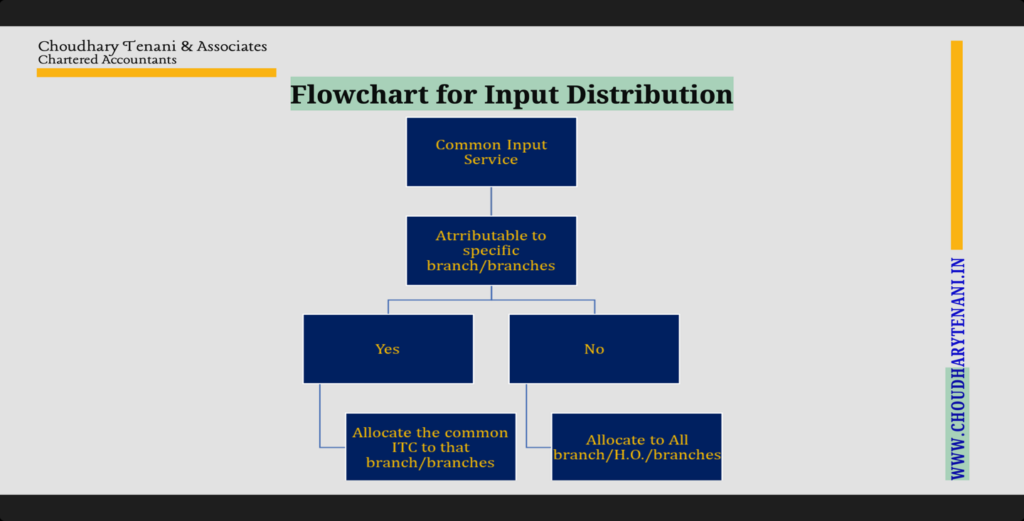

The flowcharts supplied by Choudhary Tenani & Associates show how an ISD methodically distributes input tax credits:

Step 1: Identifying Service Attribution

The first step is to determine whether services can be attributed to specific recipients:

- When it comes to services that are visibly used by particular branches, the ITC is only given to those branches.

- If tax bills are received directly under the recipient’s GSTIN, this step can be bypassed.

Step 2: Common Services Identification

Shared services that benefit multiple branches or the entire organization must be identified. These services must be appropriately distributed among several individuals.

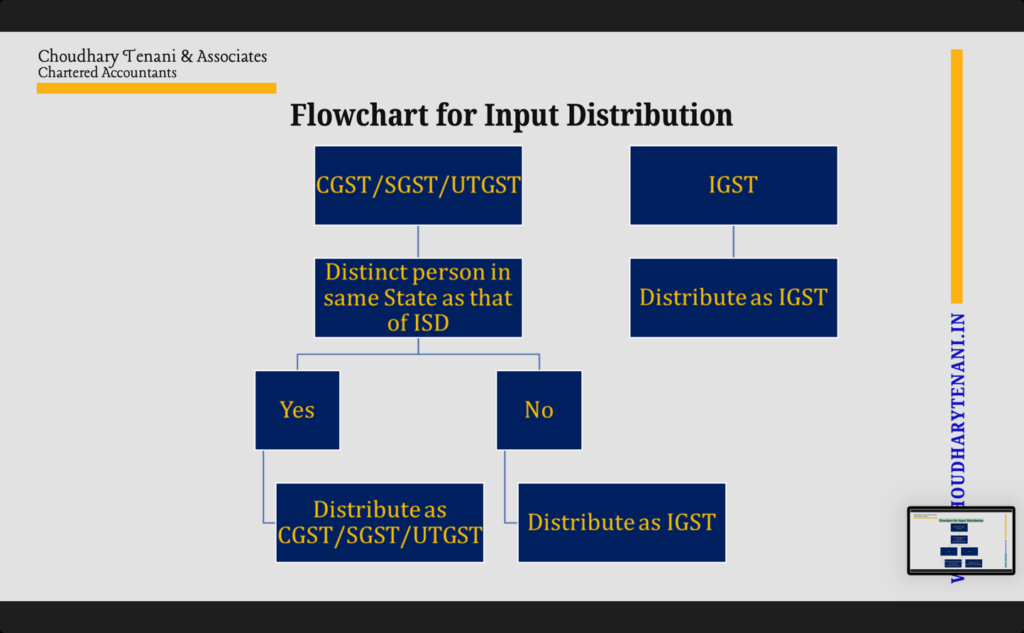

Step 3: Tax Type-Based Allocation

Depending on the kind of tax involved, several distribution mechanisms apply:

- CGST Input: If the individual is in the same state as the ISD, the CGST is distributed; if not, the IGST is distributed.

- UTGST/SGST: If the individual is in the same state as the ISD, the input is distributed as SGST/UTGST; if not, it is distributed as IGST.

- IGST Input: Regardless of location, IGST is always distributed as IGST only.

Crucial Safety Measures for ISD Operations

1. ISDs shall take the following safety measures to guarantee compliance and efficient ITC distribution:

- Separate registration: ISDs must obtain a separate registration and submit returns using Form GSTR-6. As per Rule 54(1), ISDs must issue Input Service Distributor invoices indicating that they are exclusively for the distribution of ITC.

2. Invoice Management: The ISD must receive all common service invoices with its GSTIN on them.

3. Credit Limitations: Regardless of whether the recipients can utilize it, the distributed ITC cannot ever be greater than the available ITC.

4. Managing Debit Notes: ITC accrued via debit notes must be disbursed in the same manner as tax invoices.

5. Credit Note Issuance: The ISD is required to issue an Input Service Distributor credit note and distribute the reduction in the same ratio as the initial distribution if the previously distributed ITC is subsequently reduced for whatever reason.

6. Reverse Charge Mechanism: ISDs are required to disburse ITC for services that are subject to RCM; however, as the input under the reverse charge mechanism cannot be utilized until payment is made, the government needs to provide more clarification on this point.

7. Handling Reversals: By the Act’s regulations, input tax credits that must be reversed should also be distributed, with each registered entity responsible for reversing the applicable ITC.

8. Turnover-Based Distribution: Each individual’s turnover in the state during the previous fiscal year must serve as the basis for the common input distribution. If turnover data for the most recent fiscal year is unavailable, the turnover from the preceding quarter should be used.

9. Inclusive Turnover Calculation: Both taxable and non-taxable supplies must be included in the turnover calculation.

10. Error Correction: ISD shall file returns in form GSTR-6; Any correction of an erroneous distribution must be made in the subsequent period during the filing of Form GSTR-6.

Practical Application Through Flowcharts

The distribution process is simplified through the flowcharts provided:

Flowchart 1: Common Input Distribution

This flowchart illustrates the decision-making process for common input services:

- When a common input service is received, assess whether it can be attributed to specific branches.

- If yes, allocate the ITC only to those specific branches

- If no, allocate the ITC to all branches/head offices based on the turnover ratio.

Flowchart 2: Tax Type-Based Distribution

This flowchart demonstrates how different types of taxes are distributed:

- For CGST/SGST/UTGST inputs:

- If the distinct person is in the same state as the ISD, distribute as CGST/SGST/UTGST

- If located in a different state, distribute it as IGST.

- For IGST inputs, always distribute as IGST regardless of location.

In conclusion

One essential element of the GST architecture that makes it possible for companies with numerous registrations to effectively distribute input tax credits is the Input Service Distributor mechanism. Businesses can guarantee compliance while optimizing their use of tax credits by following the recommended technique and taking the safeguards mentioned.

Choudhary Tenani & Associates’ flowcharts facilitate a clearer application of this complex aspect of GST compliance, which provides a clear visual picture of the decision-making process involved in ITC distribution.

Companies with multiple registrations must understand and properly implement the ISD mechanism to optimize tax management and ensure compliance. Robust internal controls must be established to prevent errors and enable their timely detection and rectification.

Disclaimer

The content published on this blog is for informational purposes only. The opinions expressed here are solely those of the respective authors and do not necessarily reflect the views of Fintrac Advisors. No warranties are made regarding the completeness, reliability, or accuracy of this information. Any action taken based on the information presented in this blog is strictly at your own risk, and we will not be liable for any losses or damages resulting from its use. Professional consultation is recommended for any related work. External links on our blog may direct users to third-party sites beyond our control. We do not take responsibility for their nature, content, or availability.